12/2024

Unlock Profits With Crypto Pair Trading

Pair trading in the cryptocurrency market is a sophisticated strategy that capitalizes on the relative price movements of two assets that have a statistical correlation. Unlike directional trading, where traders bet on the absolute rise or fall of a single asset, pair trading focuses on the relationship between two assets. The core premise is that when this relationship deviates from its historical norm, it will eventually revert. This reversion to the mean is where the profit opportunity lies. In essence, instead of profiting from the trend of a single coin, you profit from the mispricing between two coins.

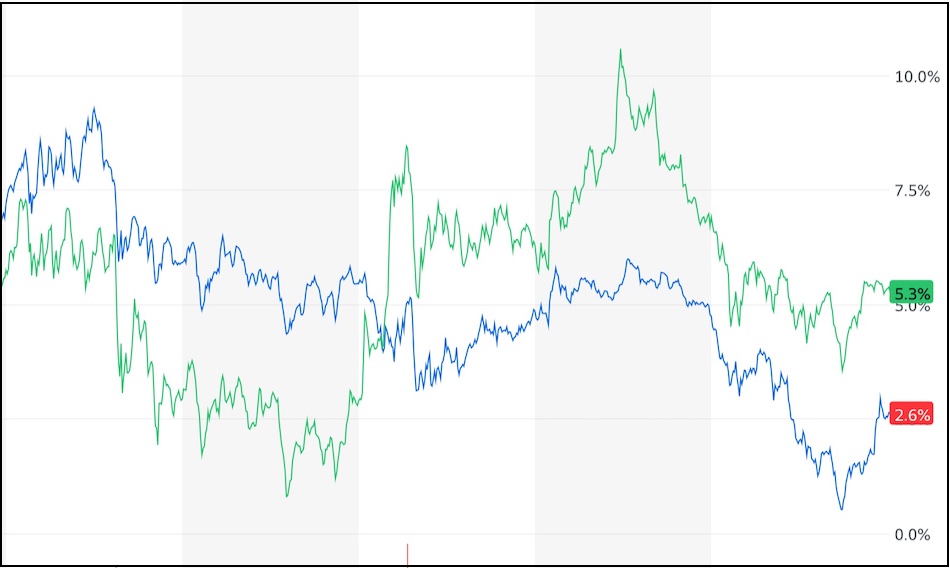

The trading strategy begins with identifying two cryptocurrencies that tend to move in tandem. This could be due to various factors, such as being in the same ecosystem, having similar utilities, or simply because market perception often groups them together. Once such a pair has been identified, the next step is to monitor their price relationship. When that relationship diverges, for instance, one coin becomes overvalued relative to the other, a pair trader would short the relatively overvalued asset and simultaneously buy the relatively undervalued one. The key here is the "relative" concept. It's not about whether either coin is a good investment on its own, but about their relationship. The trader is betting that the prices will converge, and once they do, both positions are closed, realizing a profit from the corrected mispricing.

Examples of coin pairs suitable for this strategy include AVAX (Avalanche) paired with another asset in the same ecosystem. BTC versus ETH is another common pairing, as these are the two largest cryptocurrencies. Pairs can also be formed with ETH and different fiat currency pairs like CAD, EUR, GBP, and USD, provided these show a correlation on the corresponding exchanges. The more cointegrated the pairing is the better the strategy should perform, since cointegration means that there is a long term relationship between them. A correlation may change over time, but a cointegration will remain.

While often touted as a lower-risk strategy compared to directional trading, pair trading is not without perils. The primary risk is that the correlation between the paired assets could break down. If the correlation deteriorates instead of reverting, price divergence may widen further instead of narrowing, resulting in losses. There's also a systemic risk associated with the market fluctuations which can affect both assets negatively. This is where deep knowledge of the assets' underpinnings comes in handy, allowing traders to assess risks. Another risk is the need for quick trade execution to capture these subtle price differences, as arbitrage opportunities can vanish very quickly. Using automated bots and reliable trade execution platforms is necessary.

When implemented with a good understanding of market dynamics and risk management, pair trading can be profitable. It capitalizes on short-term arbitrage opportunities, and it's less dependent on overall market direction, acting as a market-neutral strategy. Some strategies using pair trading have been reported to provide a 3% monthly profit, although this is not guaranteed and can fluctuate based on market conditions and the chosen trading pair. Certain strategies focusing on pairs have been reported to deliver high excess returns and other metrics such as Sharpe Ratio and Information Ratio, showing the potential to attain a consistent and sustainable excess return when handled with a deep understanding of the market.

A critical part of implementing this strategy is the concept of market neutrality. In an ideal pair trade the combined value of the portfolio remains stable, regardless of whether the market is going up or down. This stability occurs because losing on one asset will be equal to gaining on the other asset. This helps protect the traders portfolio by minimizing its correlation with the overall market movements, which is an advantage compared to regular trading strategies.

In conclusion, pair trading strategy is not for beginners. It requires rigorous research, good execution, risk management, an in-depth understanding of cointegration, and sometimes automated bots execute the strategy fast enough to capture the opportunities, Pair trading offers an interesting path for more experienced traders to profit on the cryptocurrency volatility while protecting from larger moves in the market and reducing risk.

More topics on Blogs and Articles.